- Call Us Now 020 3728 4700

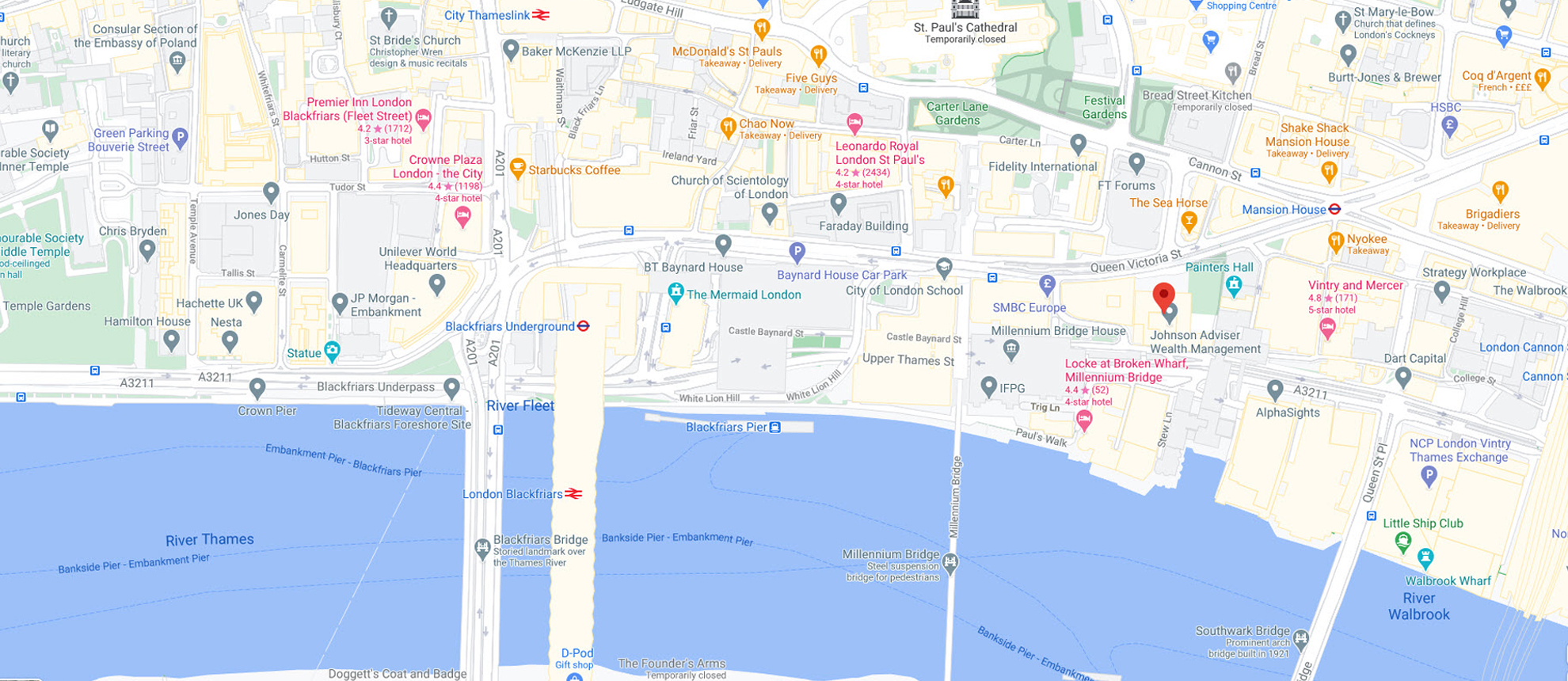

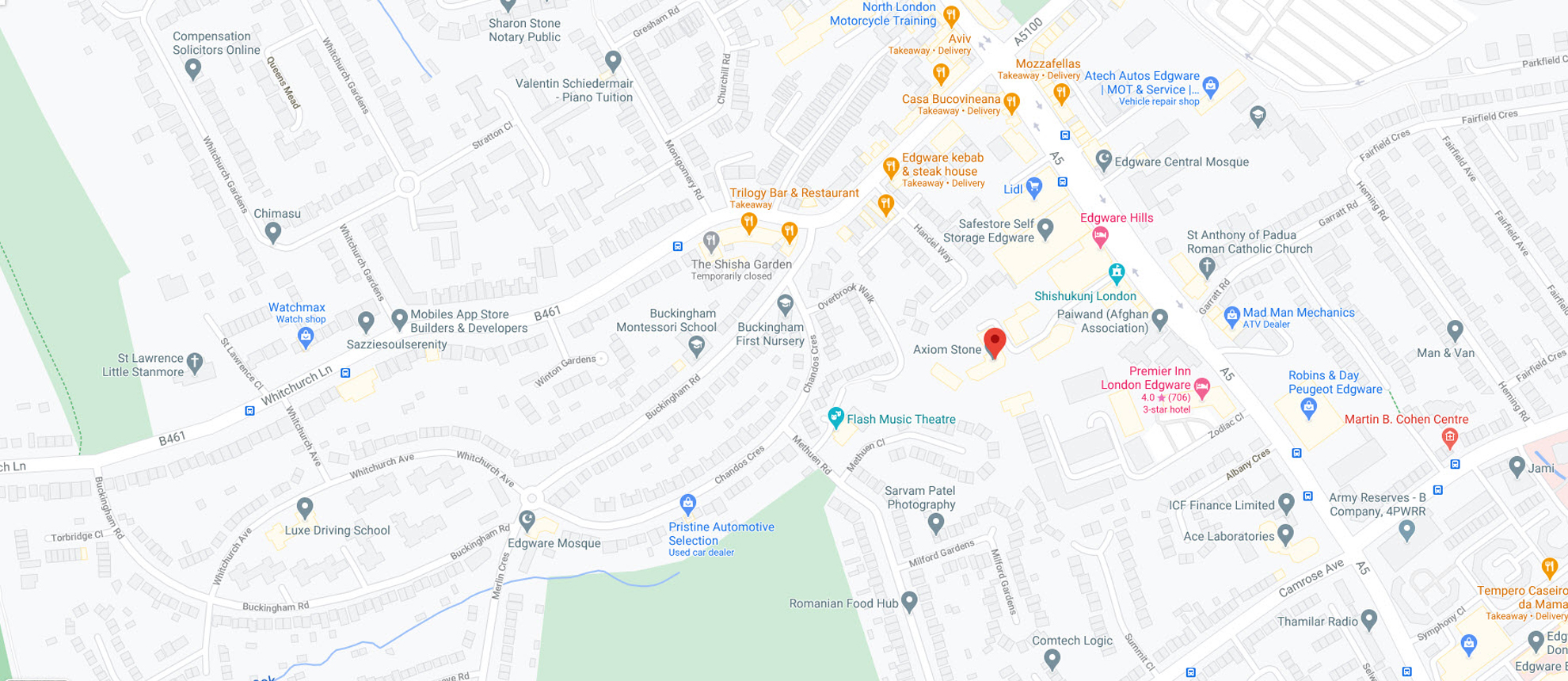

Arigal Consulting Ltd is privately owned, and not affiliated to any bank, building society, insurance or any service provider, providing expert mortgage advice to a wide range of clients, with offices both in the City and in North West London.

We have always been particularly successful with helping clients reduce their monthly outgoings, reduce their taxes, increase their wealth and preserve any capital built up, and work very closely with clients to tailor their individual requirements.

We cultivate very close relationships with our clients, and everything is always explained in a very clear, easy to understand, layman’s manner, meaning you actually understand what we’re discussing.

We offer face to face advice to both private and corporate clients.

We work hard to keep up to date with all regulatory changes and professional standards so that we may offer the most relevant advice to our clients.

We are very blunt (in a lovely way!), very clear and transparent and attract clients because we work so differently to most financial services businesses. This style seems to have brought clients to our MD, Jeremy Kosiner, from near and far since 1993.

Our clients stay with us because our team-based approach delivers a unique blend of specialist skills gained over 30 years.

Whether you are a private individual, a company, a trust, or a charity, we have the technical know-how and relationship experience to assist you with all of your wealth matters.

Never before has managing your money and planning your financial future been as important as it is today. There is no charge for initial consultations, so contact us and find out how you can benefit from Arigal’s expertise.

Our Approach

Arigal Consulting provide a bespoke planning service for clients’ needs, we believe in your dreams like they are our own. We will be with you every step of your journey. Furthermore, we have access to the whole of the market for mortgages, which saves you approaching lots of lenders yourself.

We see the whole process through from start to finish which includes:-

- Meeting up in person or on the phone to discuss your requirements in detail

- Discussing all options relating to any existing or previous arrangements you have had

- Discussing what you will and won’t require in relation to financial products

- Ensuring everything fits within your budget

- Liaising and negotiating on your behalf with any solicitor, accountant, estate agent, or indeed any product provider as required

- Completing all forms and handling all administration for you

The value of investments and pensions and the income they produce can fall as well as rise. You may get back less than you invested.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Our clients are at the very centre of all our thoughts and actions. Over the years, we have learned just how much they value these core characteristics:-

- Putting clients at ease

- Knowledge

- Experience

- Trust

- Continuity of Service

- Security

- Regular Communication

Through consistently applying these core values across every aspect of our business, we have arrived at one of the most compelling, client-centred offerings currently available. Put simply, it is our “what would I want if I were a client?” approach.

It is a culture that is shared by all Arigal Consulting’s advisers and support staff. And we make sure we maintain it by attracting and retaining highly-experienced, technical, personable advisers, ensuring you will continue to benefit from a first class service that satisfies all these values.

The personal, service-based relationship with your advisor will be central to your engagement with Arigal Consulting. Your adviser will develop an in-depth understanding of your current position, needs, and goals in order to establish a working financial plan and appropriate level of service. They will also take responsibility for the ongoing delivery of your plan, and will chaperone you to the appropriate specialist adviser whenever your circumstances dictate.